Marriage History

Note: this post originally posted on July 20, 2004. I'm reposting it because I thought this would be helpful to Adam O'Neill (it's about time, I've taken without giving back long enough).

Many conservatives and Christians fear that the traditional family values are under siege. They feel that they must combat any beachhead on the assault against the institution of marriage. Thus, many slippery-slope arguments are used to multiply the arguments against the two main offenders, same-sex marriages and legalized abortions. But what is the traditional family?

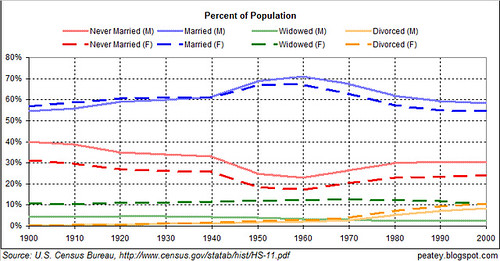

From the Percent of Population chart, we see that less people are married in recent decades than in the 1960-1970 because more Americans have divorced or have never married. But looking back to even more "traditional" times, we see that, compared to recent decades, even larger percent of Americans were never married in the first four decades of this century.

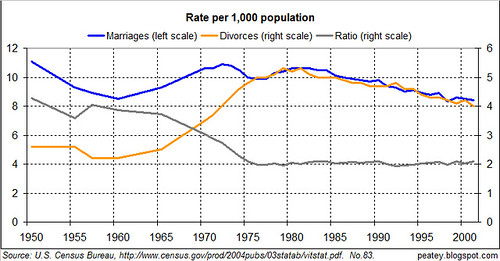

While marriage rate per 1,000 population has decreased since 1980, the divorce rate per 1,000 population has decreased the same proportion, so that the ratio has remained constant since 1977. Each year, Americans marry twice as often as they divorce.

It is very likely that a large factor of the rise in the divorce rate from 1965 to 1975 was the advent of no-fault divorce laws. However, I hypothesize that the increase in divorce rate is merely the delayed consequence of the prior increase in marriage rate.

I suspect that the marriage rate data paints a worse picture for the institution of marriage because more of the denominator of 1,000 population is constituted from the againg baby-boomers, whose marriage/re-marriage pattern is less important for the health of the institution of marriage. Furthermore, the already-married status of the immigrants are not counted, further diminishing the rate per 1,000. The immigration bias probably does not exist for divorces because emigrants seem to be a lot fewer in numbers. It would be nice to be able to isolate marriage and divorce rates among only the younger generation, or only the first-time marriages and divorces, but such data are unavailable to me.

Americans seem to be marrying less, but maybe not. Americans are definitely getting divorced less, but still at a higher rate than "traditionally." However, about the same percent of Americans are married at the end of the 20th Century as at the beginning. In that century, about 10% of Americans have been "liberated" from the never married category, but the ranks of the divorced Americans have swelled by almost 10%.

In the future, I will examine other measurements of "traditional family values." But as expressed through marriages and marital rates, I do not see an unprecedented crisis of the institution of marriage. If I am blind, help me see through your comments.

Is the conservative goal to have 70% of American males in holy matrimony again?

Mawage. Mawage is wot bwings us togeder tooday. Mawage, that bwessed awangment, that dweam wifin a dweam...”

Many conservatives and Christians fear that the traditional family values are under siege. They feel that they must combat any beachhead on the assault against the institution of marriage. Thus, many slippery-slope arguments are used to multiply the arguments against the two main offenders, same-sex marriages and legalized abortions. But what is the traditional family?

From the Percent of Population chart, we see that less people are married in recent decades than in the 1960-1970 because more Americans have divorced or have never married. But looking back to even more "traditional" times, we see that, compared to recent decades, even larger percent of Americans were never married in the first four decades of this century.

While marriage rate per 1,000 population has decreased since 1980, the divorce rate per 1,000 population has decreased the same proportion, so that the ratio has remained constant since 1977. Each year, Americans marry twice as often as they divorce.

It is very likely that a large factor of the rise in the divorce rate from 1965 to 1975 was the advent of no-fault divorce laws. However, I hypothesize that the increase in divorce rate is merely the delayed consequence of the prior increase in marriage rate.

I suspect that the marriage rate data paints a worse picture for the institution of marriage because more of the denominator of 1,000 population is constituted from the againg baby-boomers, whose marriage/re-marriage pattern is less important for the health of the institution of marriage. Furthermore, the already-married status of the immigrants are not counted, further diminishing the rate per 1,000. The immigration bias probably does not exist for divorces because emigrants seem to be a lot fewer in numbers. It would be nice to be able to isolate marriage and divorce rates among only the younger generation, or only the first-time marriages and divorces, but such data are unavailable to me.

Americans seem to be marrying less, but maybe not. Americans are definitely getting divorced less, but still at a higher rate than "traditionally." However, about the same percent of Americans are married at the end of the 20th Century as at the beginning. In that century, about 10% of Americans have been "liberated" from the never married category, but the ranks of the divorced Americans have swelled by almost 10%.

In the future, I will examine other measurements of "traditional family values." But as expressed through marriages and marital rates, I do not see an unprecedented crisis of the institution of marriage. If I am blind, help me see through your comments.

Is the conservative goal to have 70% of American males in holy matrimony again?